3 Defensive Stocks That Can Weather Any Recession

When the market becomes turbulent, investors tend to move away from high-growth, volatile stocks and toward companies with strong fundamentals, long-term business models, and the ability to generate cash flow even in adverse conditions. These are known as “defensive stocks,” which are businesses that can weather recessions while still returning money to shareholders through dividends. Among them, these three stand out to me.

Defensive Stock #1: Pfizer

Pfizer (PFE) is one of the world’s largest pharmaceutical companies, with a history dating back over 170 years. The company’s size, diverse portfolio, robust pipeline, and strong balance sheet position it to weather economic downturns effectively. Furthermore, healthcare products are always in demand, regardless of macroeconomic conditions, making its business defensive. Pfizer has a long track record of paying dividends, with a yield of 6.8%, which is higher than the healthcare sector average of 1.6%. This makes it appealing to income-seeking investors, especially during periods of volatility when steady cash returns become more valuable. The company has also raised its dividends for the past 16 years.

Pfizer’s product portfolio is diverse across multiple therapeutic areas, providing an additional layer of stability. Pfizer is well-known for its COVID-19 vaccine, but it also offers Prevnar 13 and 20, which protect against pneumococcal disease. The company co-markets Eliquis, one of the world’s most popular anticoagulants. In addition, its oncology division includes Ibrance (used in breast cancer treatment), as well as a number of pipeline candidates that address unmet needs in cancer therapies.

In the second quarter, Pfizer’s total revenue rose 10% year on year to $14.6 billion, while adjusted earnings per share (EPS) increased 30% to $0.78. Pfizer’s payout ratio (the amount of earnings paid out in dividends) is a reasonable 55%, allowing for dividend growth and business development. In the first half of 2025, the company paid out $4.9 million in cash dividends, with $150 million reinvested in business development.

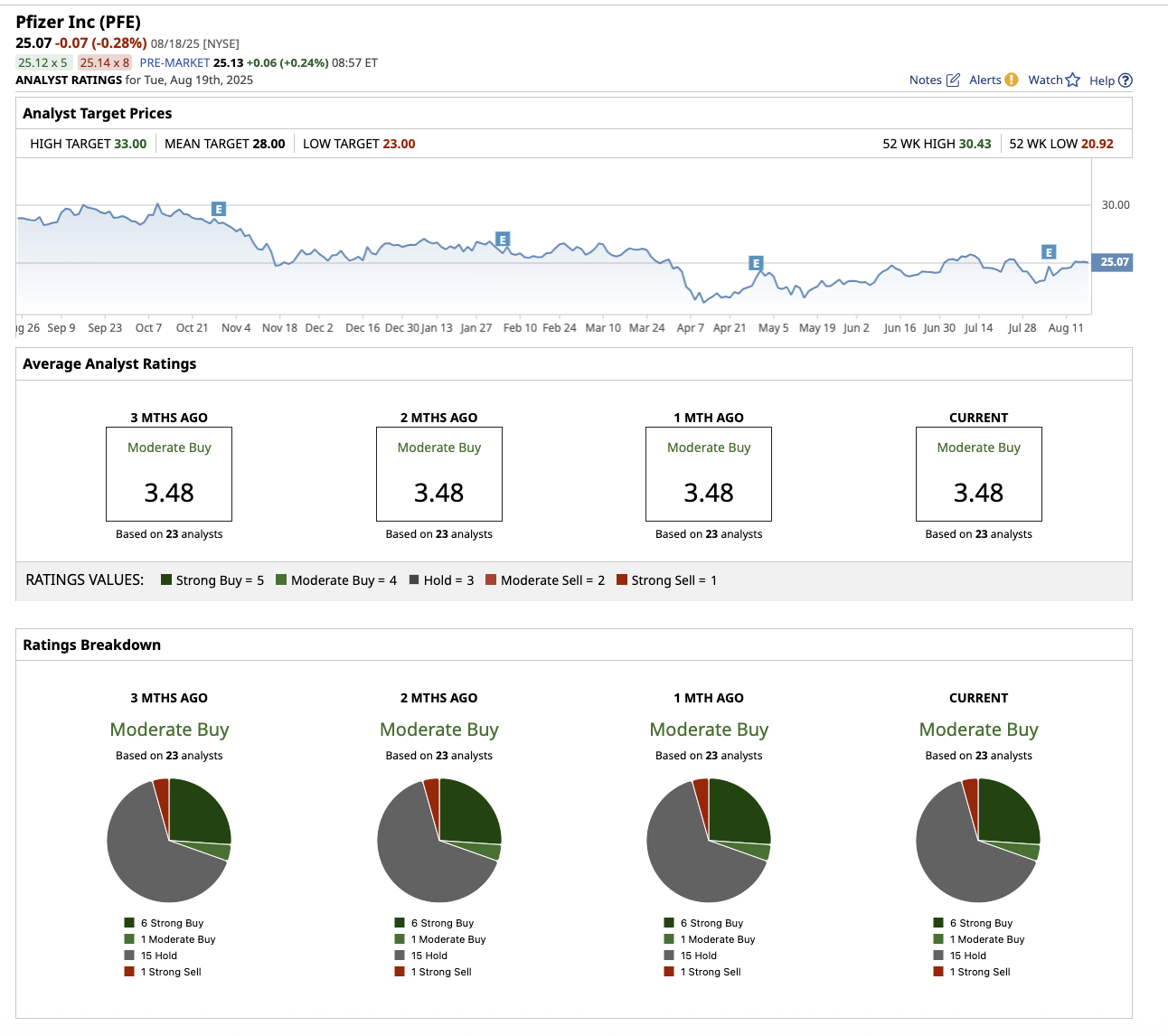

On Wall Street, overall, Pfizer stock is rated a “Moderate Buy.” Out of the 23 analysts who cover PFE stock, six rate it a “Strong Buy,” one says it is a “Moderate Buy,” 15 rate it a “Hold," and one suggests a “Strong Sell.” Its average price target of $28 suggests that the stock can increase by 11.7% over current levels. However, its high target price of $33 implies upside potential of 31.6% over the next 12 months.

Defensive Stock #2: NextEra Energy

With a market cap of $155.9 billion, NextEra Energy (NEE) is the largest electric utility holding company in the United States. It has two primary subsidiaries. The first is Florida Power & Light (FPL), which provides electricity to homes and businesses through long-term regulatory agreements. The second is NextEra Energy Resources (NEER), which produces renewable energy through wind and solar. Electric utilities have long been regarded as classic defensive investments. Regardless of economic circumstances, residences and businesses require electricity. This stability has enabled NextEra to continue delivering strong financial results while rewarding shareholders with increasing dividends.

NextEra has paid and increased its dividends for the past 31 years, earning the title of Dividend Aristocrat. It has a forward dividend yield of 3%, compared to the utilities sector average of 3.8%. The company’s forward payout ratio of 56.9% implies that dividends are currently sustainable if earnings continue to rise. In the second quarter, NextEra’s adjusted earnings increased by 9.4% to $1.05 per share. Analysts expect the company’s earnings to rise 7% in 2025, followed by another 8% in 2026. The company intends to increase dividends by about 10% per year until 2026.

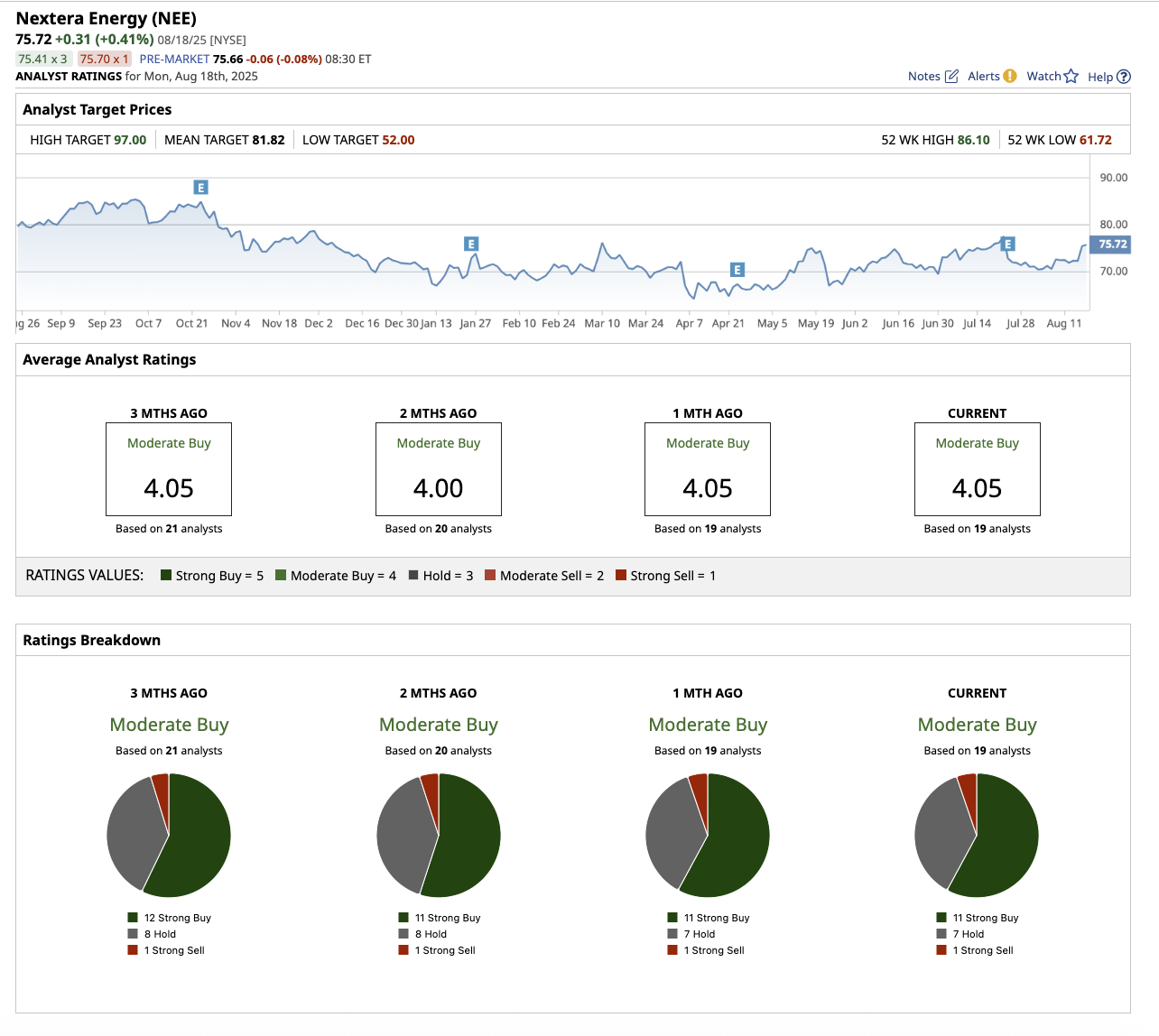

Overall, analysts have an average rating of “Moderate Buy” for NEE stock. Its mean target price of $81.82 suggests the stock can climb by 8% from current levels. However, its high target price of $97 implies upside potential of 28.1% over the next 12 months. Out of 19 analysts covering the stock, 11 have a “Strong Buy” rating, seven have a “Hold” rating, and one rates it a “Strong Sell.”

Defensive Stock #3: Realty Income

Realty Income (O) has built its reputation by providing investors with a consistent stream of cash distributions every month for decades. It is commonly referred to as “The Monthly Dividend Company.” Realty Income is a real estate investment trust (REIT) that specializes in net lease properties, which are primarily leased to tenants across recession-resistant industries such as retail, industrial, and service sectors.

The company’s business model is based on stability, as it signs long-term leases, often for nine years or more, with built-in rent increases. This generates a consistent and growing stream of cash flows, which support the company’s monthly dividend payments. The company’s 5.5% yield is significantly higher than the real estate average of 4.5%, making it appealing. What is even more impressive is the company’s track record of dividend increases. Realty Income has increased its dividend for the past 30 years in a row, making it a proud member of the Dividend Aristocrats. For a REIT, funds from operations (FFO) measure the amount to be paid out as dividends. Analysts expect Realty Income’s FFO to increase by 6.7% in 2025, followed by another 3.6% in 2026.

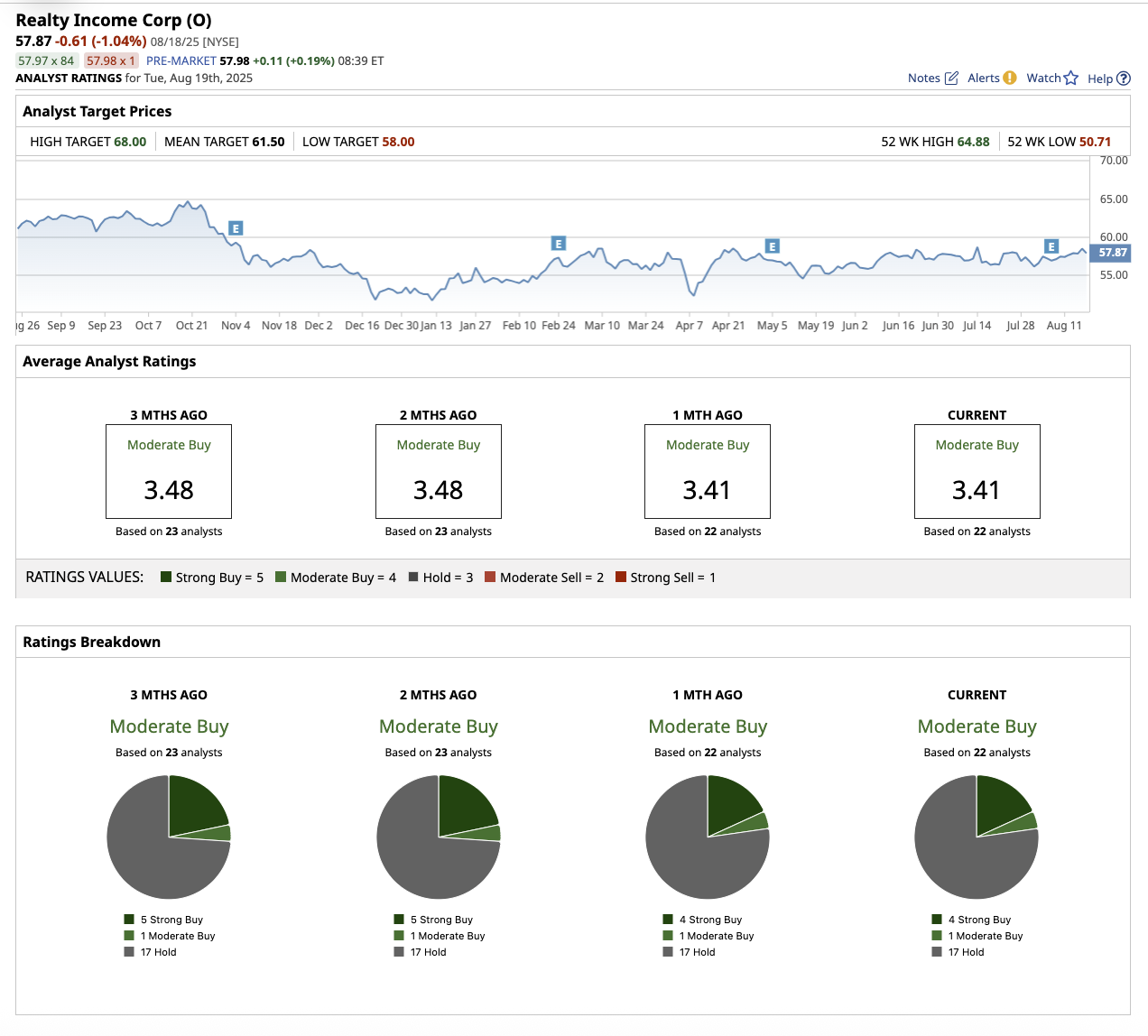

Overall, on Wall Street, Realty Income stock is a “Moderate Buy.” Out of the 22 analysts that cover the stock, four rate it a “Strong Buy,” one rates it a “Moderate Buy,” and 17 rate it a “Hold.” The mean target price for the stock is $61.50, which is 6.3% above current levels. The Street-high estimate of $68 implies upside of 17.5% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.